Written By Zsolt Jirka

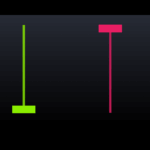

Unveiling the Forex Trading Clock: A Tour of Global Sessions

The forex market is open 24 hours a day, five days a week, with forex trading sessions spanning the globe. Let’s take a closer look at each of these sessions and what makes them unique.

Here’s the second table presented in the requested format:

| Session | Opening Time GMT | Closing Time GMT |

|---|---|---|

| Tokyo | 12:00 AM | 9:00 AM |

| Sydney | 9:00 PM | 5:00 AM |

| Frankfurt | 7:00 AM | 4:00 PM |

| London | 8:00 AM | 5:00 PM |

| New York | 1:00 PM | 10:00 PM |

The Tokyo Session

12:00 PM – 8:00 AM GMT:

- This session is known for its high liquidity, meaning there are many buyers and sellers actively trading during this time.

- Economic news and events from Japan and other Asian countries often have a significant impact on the market during the Tokyo Session.

The Sydney Session

10:00 PM – 5:00 AM GMT:

- Although smaller compared to other sessions, the Sydney Session can experience increased volatility.

- This is because it overlaps with the Tokyo Session, which can lead to more active trading.

The Frankfurt Session

7:00 AM – 4:00 PM GMT:

- Frankfurt is a major trading hub in Europe, and its session is known for high liquidity.

- Economic news and events from the European Union often influence the market during this time.

The London Session

8:00 AM – 5:00 PM GMT:

- The London Session is considered the most active and liquid session in the forex market.

- Many important economic releases and events occur during this session, making it a crucial time for traders to pay attention to the market.

The New York Session

1:00 PM – 10:00 PM GMT:

- The New York Session is known for its high trading volume.

- Economic news and events from the United States and Canada often have a significant impact on the market during this session.

Getting to know the features of each trading session can help you trade smarter in the forex market. If you know when the market is likely to be busy, quiet, or affected by big news, you can plan your trades better and keep your risk in check.

This table shows the overlap times between forex trading sessions in different cities.

| Session 1 | Session 2 | Overlap Start | Overlap End |

|---|---|---|---|

| Tokyo | Sydney | 12:00 AM GMT | 5:00 AM GMT |

| Frankfurt | London | 8:00 AM GMT | 4:00 PM GMT |

| Frankfurt | New York | 1:00 PM GMT | 4:00 PM GMT |

| London | New York | 1:00 PM GMT | 4:00 PM GMT |

Daylight Saving Time and Forex Trading

When countries change their clocks for daylight saving time, it can affect forex trading schedules. Here are a few things to keep in mind:

- Trading hours may change in countries that observe daylight saving time

- The release times of important economic news might be different

- You may need to adjust your trading plan to account for the time changes

To help you stay on top of these changes, you can use online tools like the Forex Time Zone Converter to convert session times to your local time zone. I found this tool very helpfull

Understanding Trading Sessions: Why It’s Important

Trading sessions are different times of the day when people buy and sell money from different countries. It’s good to know about these sessions because they can help you make better choices when trading.

- Active Times: Some sessions are busier than others. When a session is very active, prices might change a lot. Knowing when this happens can help you find good times to trade.

- Easy Trading: When more people are trading, it’s often easier to buy or sell. This is because there’s not as big of a difference between the buying and selling prices.

- More Chances: Sometimes, two sessions happen at the same time. For example, when people in Europe and North America are both trading. This can give you more chances to make trades.

- Staying Safe: Understanding how the market works at different times can help you make smarter decisions. This way, you can protect your money better.

In short, learning about trading sessions is very important. It can help you choose the best times to trade, find more opportunities, and keep your money safe.

Leave a Reply