Written By Zsolt Jirka

| Trend | Interpretation | Trade Opportunity |

|---|---|---|

| Upward Trend | Sellers strong, resistance holds | Short trade opportunity |

| Downward Trend | Buyers strong, support holds | Long trade opportunity |

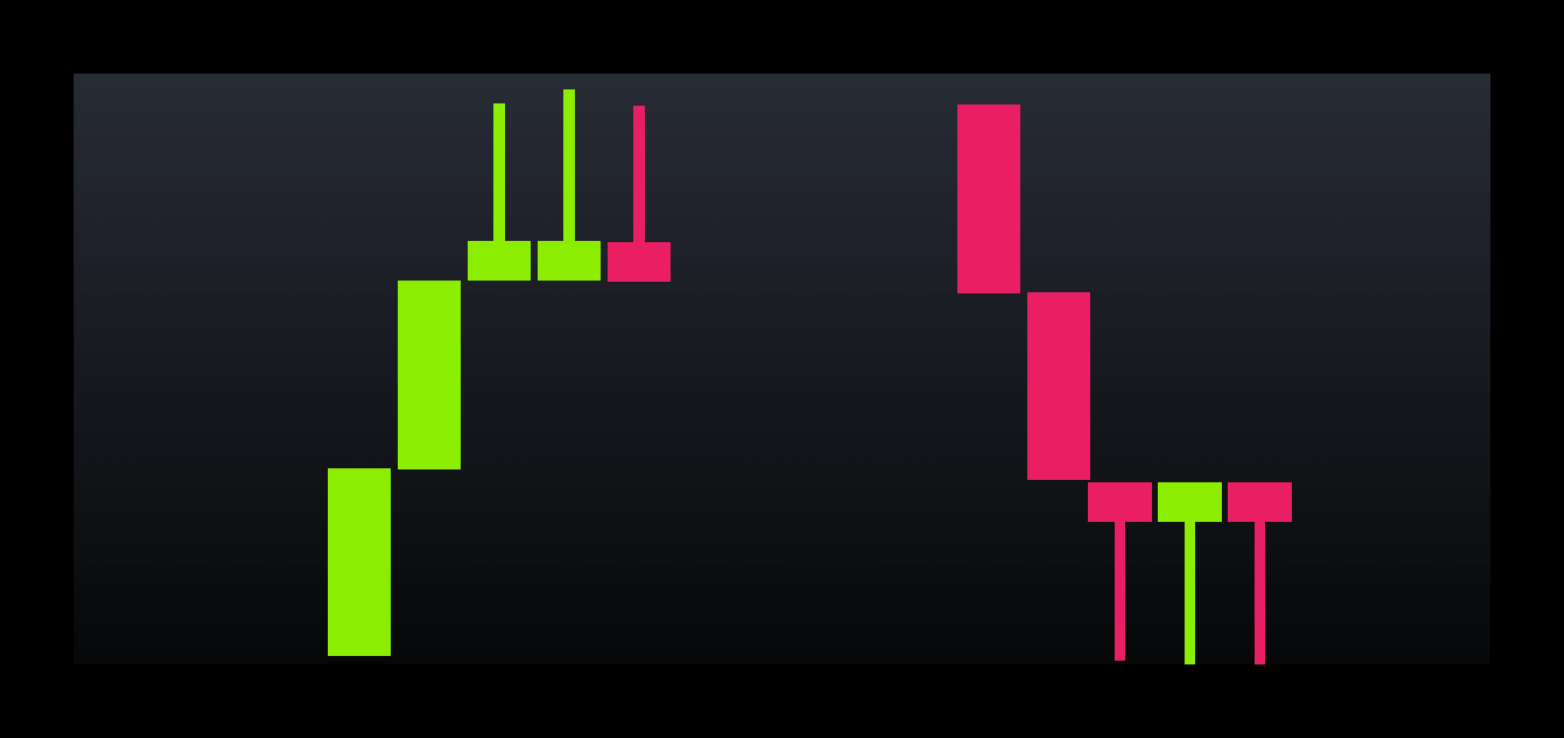

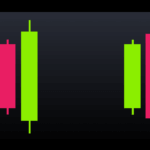

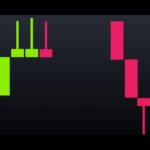

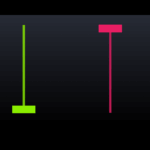

Multiple Long Wick Candles are a group of long-wick candles clustered together. If you’d like to know more about Long Wick Candles, check out my blog post on these candles.

The Psychology Behind the Candles

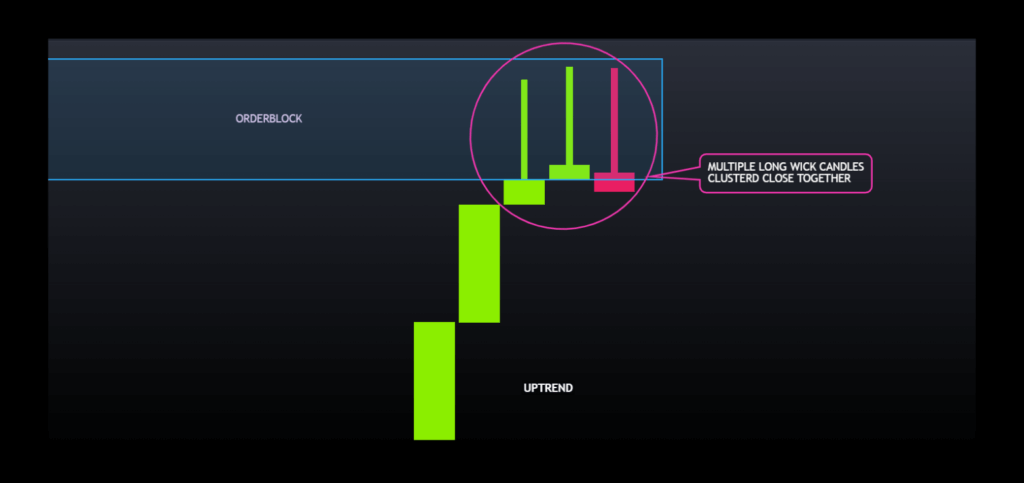

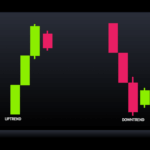

Upward Trend

- Price goes up, hits resistance, and reverses. This resistance level becomes important.

- Price tries to break through again (multiple long wicks up). Each time, it fails.

- This suggests sellers are strong, and the resistance level holds. So sellers are selling more than buyers can buy.

- Short trade opportunity: Since buyers can’t break through, the price might fall further (opportunity to buy at a lower price).

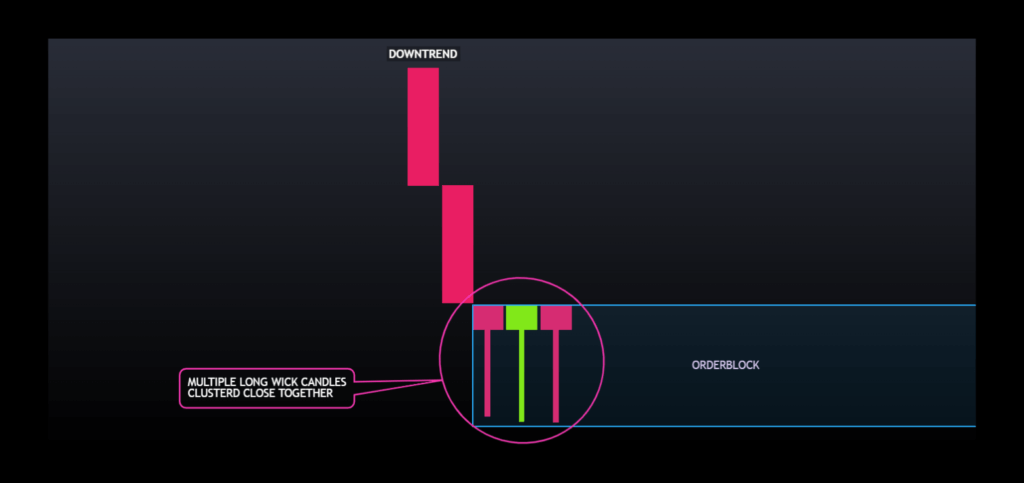

Downward Trend (Reverse the Thinking)

- Price goes down, hits support, and reverses. This support level becomes important.

- Price tries to break down again (multiple long wicks down). Each time, it fails.

- This suggests buyers are strong, and the support level holds.

- Long trade opportunity: Since sellers can’t break down, the price might rise further (opportunity to sell at a higher price).

In essence, multiple long wicks show a tug-of-war between buyers and sellers. The longer the wicks, the stronger the struggle.

Where to Look For

Look at the Orderflows, Orderblocks, and Breakerblocks. If you see this happening there, it can give you some information on how the price might change direction. But I personally don’t rely only on this pattern. I use it as a confluence.

Leave a Reply