Written By Zsolt Jirka

| Aspect | Details |

|---|---|

| Candle Characteristics | Small body, long wick candle in the direction of the trend. |

| Variations | Very small body vs. very long wick. |

| Indicative | This emphasizes that the body and wick size provide clues about buying and selling pressure. |

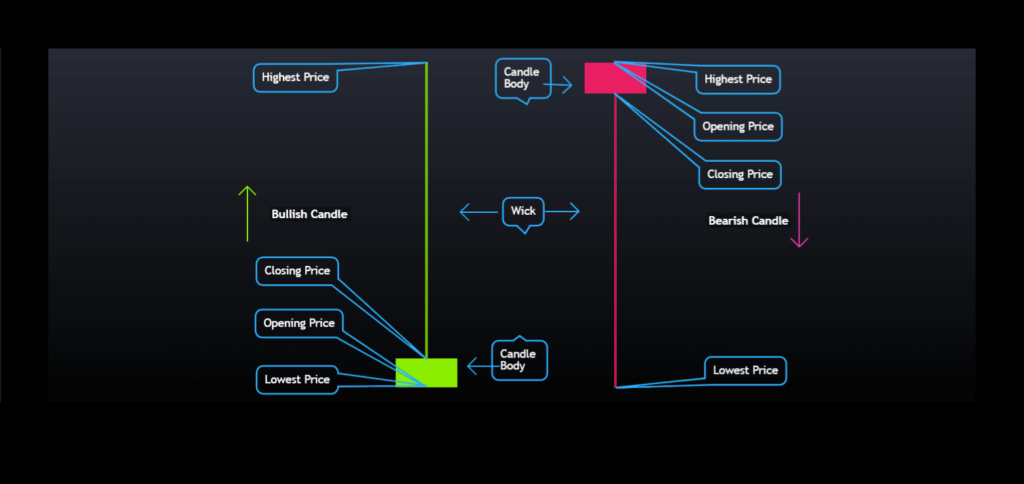

| Information Provided | Body shows opening and closing prices. Wick shows highest or lowest prices. |

| Psychology Behind Candles | Indicates market dynamics: bullish trends with buying pressure, bearish trends with selling pressure. |

| Location Importance | Look in Demand/Supply zones, Order flows, and Breaker blocks. Location and context are crucial. |

| Trading Considerations | Forex trading is about probability. Need multiple evidences before making a trade decision. |

| Actionable Insight | Do not rush into trades based on candle appearance alone. Time, place, and context matter. |

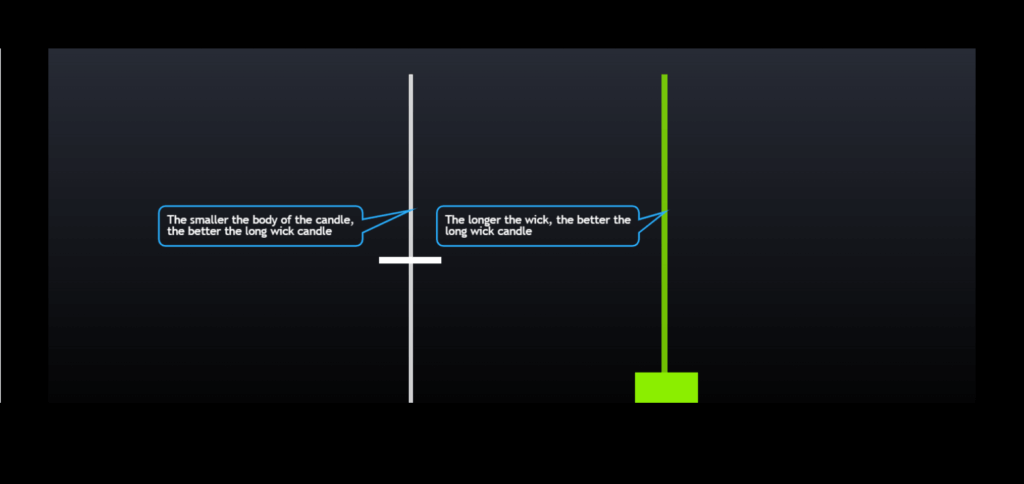

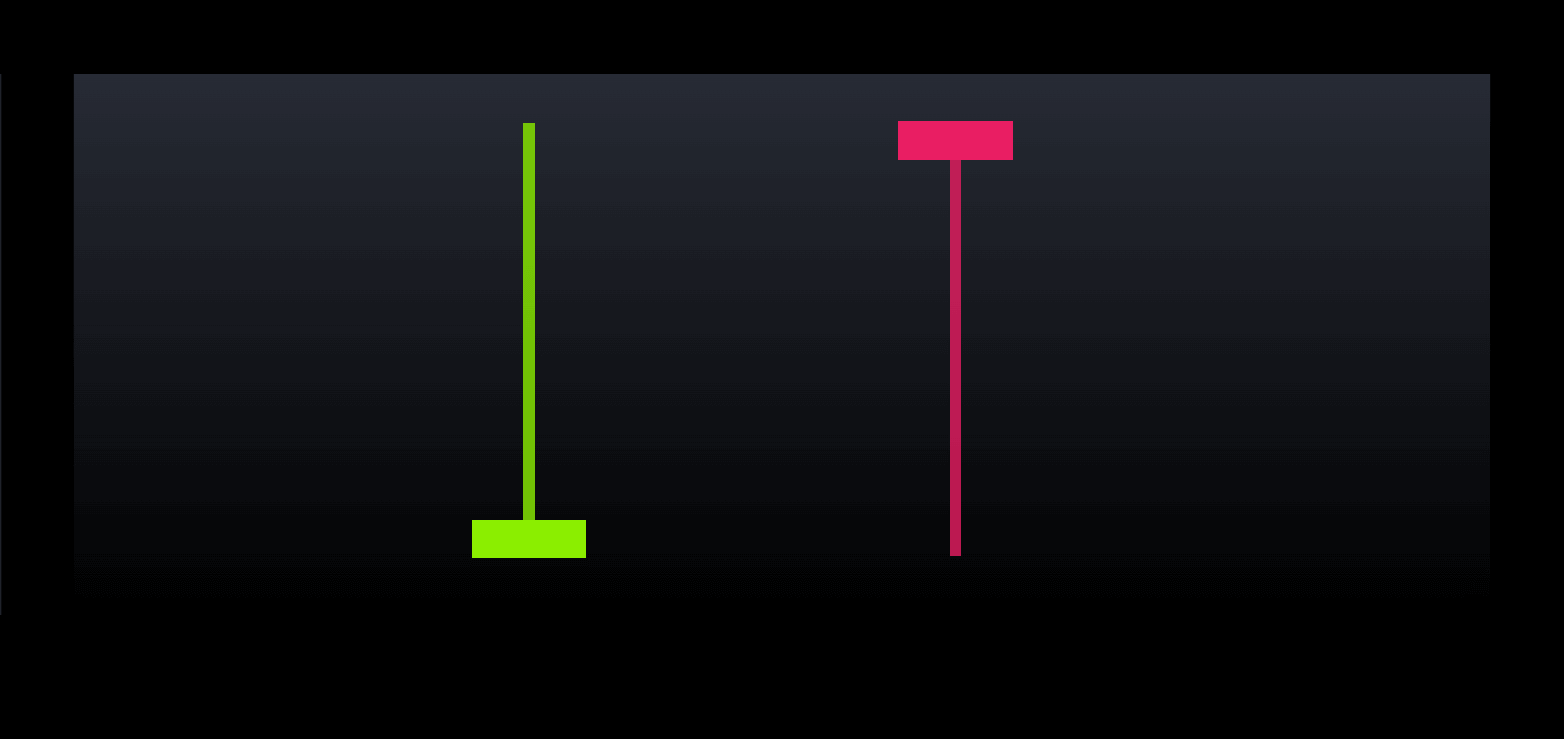

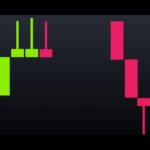

The long wick candle is a candle with a small body and a long wick in the direction as the moving trend.

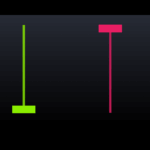

There are two variations: the ones with a very small body (white candle on image) and the ones with a very long wick (green candle on image).

The smaller the body or the longer the wick the better.

The body gives us the information where the price opened and closed. While the wick gives us the information of the highest or lowest price during the time the candle opened and closed.

Price Action Psychology Behind Long Wick Candles

So what is the key message of the long wick candle, what is it trying to tell us?

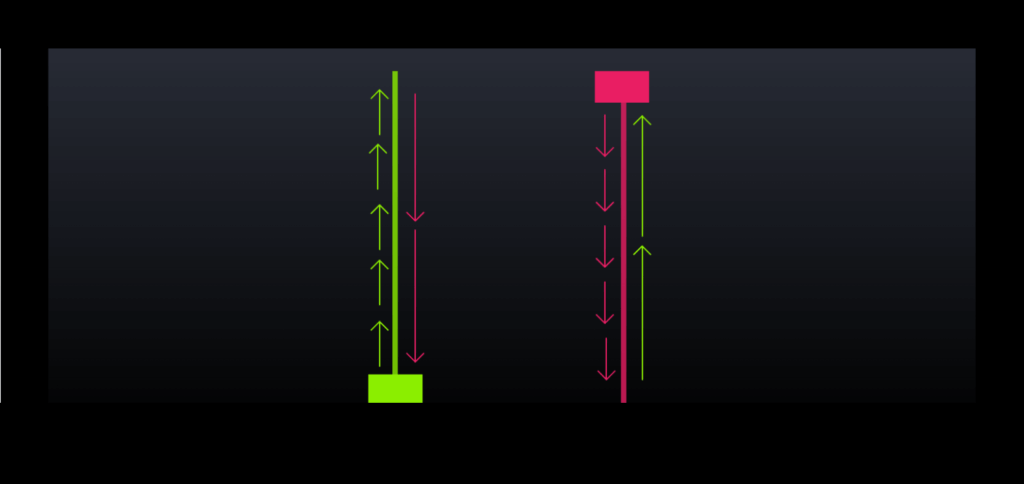

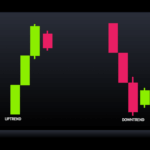

Let’s start with the long wick candle in a bullish trend.

The price was bullish. So the buyers were pushing the price up. It was a large green candle, or depending on which colors you use. I’ll use green. So it was a large green candle, and for some reason, then, sellers came back in and drove the price down from its high to near the closing price, indicating selling pressure.

As you can see, the price eventually came down near the opening price before the candle closed.

So next we have a long wick candle on a bearish trend.

The price was bearish with sellers pushing it down. It was a large red candle. However, buyers emerged and pushed the price up from its low point to near the opening price before the candle closed, suggesting buying pressure. As you can see, the price eventually came down near the opening price before the candle closed.

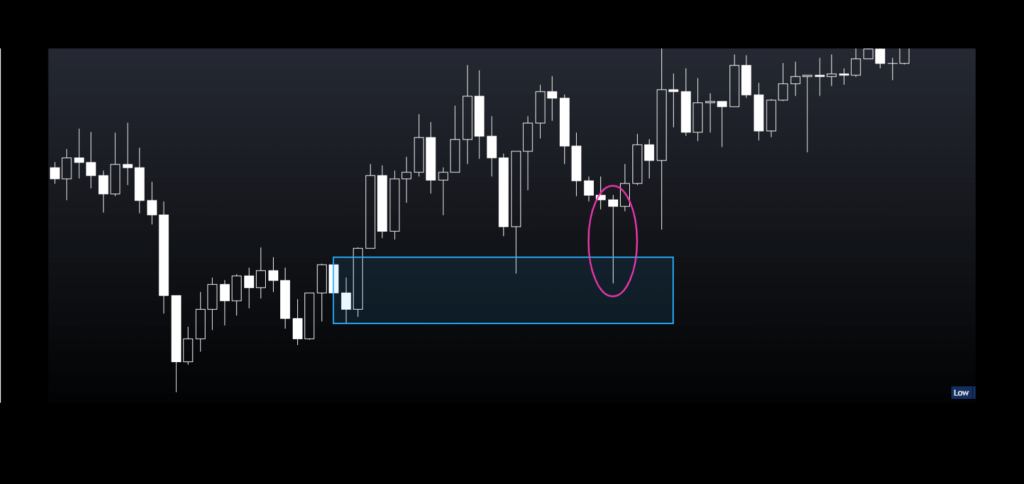

Location Matters

Where do you need to look for the long wick candle? You can look for these candles in a Demand or Supply zone, Order flows, Order flows, and Breaker blocks.

In the image above there are big bearish candles coming from the orderblock. The price retraces and approaches the order block, forming a long bullish candle with a significant upper wick. This initial move suggests buying pressure. However, strong selling pressure emerges at the order block, preventing the price from rising much higher. The candle in the red circle, with a long upper wick but closing near its opening price, reflects this selling pressure limiting the upside move.

In the image, price approaches the order block, forming a long bearish candle with a significant lower wick. This initial move suggests selling pressure. However, strong buying pressure emerges at the order block, driving the price up significantly. The candle in the red circle, with a long lower wick but closing near its opening price, reflects this buying pressure overcoming the initial selling pressure.

So don’t just search randomly take this candle and open a buy or sell order. Because location and context matter.

Please keep in mind that Forex trading is all about probability and nothing is for sure.

So how do I use this candle?

I am building a case and I am searching for evidence. and I need 5 or more things before I can make a decision if I can trade, if so would I open a buy or sell order.

So don’t rush into a trade when you see this candle without knowing the time, place, and context. Because it matters.

Leave a Reply