Written By Zsolt Jirka

Here’s a table summarizing the key takeaways from the article on “Introduction to Forex Trading”:

| Section | What is the Forex Market Key Takeaways |

|---|---|

| Introduction to Forex Trading | Forex trading involves the exchange of currencies globally, facilitating international business and travel. It operates on a large scale, much like swapping money with a friend but internationally. |

| Understanding Currency Pairs | Currencies are traded in pairs, with the first being the base currency and the second the quote currency. This pair indicates how much of the quote currency is needed to purchase one unit of the base currency. |

| Why Do People Trade Forex | Forex trading enables currency exchange for travelers and international businesses, ensuring smooth financial transactions across borders. |

| Importance for International Companies | Companies like Apple depend on forex trading to convert earnings from foreign sales into their home currency, crucial for operating globally and managing finances effectively. |

| Role of Forex Traders | Traders, including individuals and institutions, engage in forex trading to profit from exchange rate fluctuations. The market includes banks, central banks, investment managers, hedge funds, multinational corporations, and individual investors. |

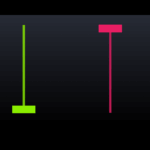

| How Forex Trading Works | Buying a currency pair means purchasing the base currency and selling the quote currency, and vice versa for selling. Prices are determined in the currency markets, influenced by global economic and political events. |

| Currency Markets: Where the Action Happens | Trading occurs in currency markets around the world, with prices fluctuating based on global events. These markets determine the exchange rates for different currency pairs. |

| Forex Trading: Always Open | The forex market operates 24/5 due to different time zones, ensuring continuous trading activity. This round-the-clock operation is facilitated by the global nature of currency markets. |

| Lots of Trading, All the Time | The forex market’s liquidity and volume, with a daily trading volume of over $6.6 trillion, mean it’s usually easy to execute trades without significant price changes. |

| Foreign Exchange Trading Explained | Forex trading is the global buying and selling of currencies, characterized by its 24-hour operation, making it the largest and most liquid financial market. Reasons for trading include speculation, hedging, and investment. |

| Risks and Rewards of Forex Trading | Forex trading offers high risk and reward due to market volatility and the use of leverage, which can amplify both profits and losses. Success requires understanding the market, strategic planning, and disciplined risk management. |

| Conclusion | Forex trading plays a vital role in the global economy, offering opportunities for profit but also carrying inherent risks. A successful trading strategy involves thorough market knowledge and careful risk management. |

Introduction to What is the Forex Market?

Forex trading is the buying and selling of different countries’ currencies. It’s like swapping money with a friend from another country, but on a much bigger scale. Forex trading helps people and businesses from all over the world work together and exchange money when they need to.

Understanding Currency Pairs

In forex trading, currencies always come in pairs. It’s like having a best friend – you always stick together! For example, if you want to swap U.S. dollars for euros, you would trade the USD/EUR pair. The first currency (USD) is called the base currency, and the second (EUR) is called the quote currency.

Who Trades in Forex

Imagine you’re planning a trip to a different country. Just like you would need to exchange your money for the currency they use there, forex trading allows currencies to be swapped on a worldwide scale. This is important not just for travelers but also for businesses that operate in multiple countries.

The Importance of Forex for International Companies

Big companies that sell their products in different parts of the world, like Apple, rely on forex trading to do their business smoothly. When Apple sells an iPhone in Europe, they receive euros. However, as an American company, they need to convert those euros back into US dollars. Forex trading makes this possible by allowing Apple to exchange the euros for dollars at the current market rate.

This process is crucial for Apple to manage its money effectively, even though they deal with many different currencies across the globe. Without forex trading, it would be much harder for companies like Apple to operate in multiple countries.

The Role of Forex Traders

Forex traders also play a significant role in this global exchange. They buy and sell currencies, hoping to make a profit from the changes in exchange rates. These traders can be individuals, banks, or other financial institutions.

Some key participants in the forex market include:

- Commercial banks

- Central banks

- Investment managers and hedge funds

- Multinational corporations

- Individual investors

- Daytraders

Forex trading happens 24 hours a day, five days a week, across major financial centers worldwide. This non-stop activity is possible because of the different time zones, allowing traders to buy and sell currencies at any time.

In summary, forex trading is essential for exchanging currencies globally, whether for personal travel or international business. It enables companies like Apple to operate across borders and provides opportunities for traders to profit from the ever-changing exchange rates. Understanding the basics of forex trading helps us better appreciate its importance in today’s interconnected world economy.Add to Conversation

How Forex Trading Works

When you buy a currency pair, you’re buying the base currency and selling the quote currency. It’s like trading baseball cards with a friend – you give them one card and get a different one in return. For example, if you buy USD/EUR, you’re buying U.S. dollars and selling euros. If you sell the pair, you’re doing the opposite.

Currency Markets: Where the Action Happens

Forex trading happens in special places called currency markets. This is where all the buying and selling takes place, and it’s where the prices (exchange rates) for different currency pairs are decided. These prices can change often based on things happening in the world, like the economy or big events.

Forex Trading: Always Open

One cool thing about forex trading is that it never sleeps! It happens 24 hours a day, five days a week. This is because currency markets are located in different time zones around the world. When one market closes, another one opens, so the trading never stops.

Lots of Trading, All the Time

The forex market is always busy with lots of people buying and selling currencies. This means that it’s usually easy to trade currency pairs whenever you want, without the prices changing too much. It’s like having a big, busy marketplace where you can always find what you need. The foreign exchange market (Forex) has a daily trading volume of over $6.6 trillion.

Foreign Exchange Trading Explained

Foreign exchange trading, also known as forex trading, involves the buying and selling of currencies from different countries. This activity takes place in a global market where individuals and organizations from all over the world participate. Unlike other markets, the forex market operates 24 hours a day, five days a week, making it the largest and most liquid financial market globally.

Why Do People Trade Forex?

There are various reasons why people engage in forex trading. Some see it as an opportunity to make profits by speculating on the future movements of currency prices. They buy currencies they believe will increase in value and sell those they predict will decrease.

Others engage in forex trading as a form of hedging to protect their businesses from adverse currency price movements. For instance, a company dealing in multiple countries might use forex trading to safeguard its earnings against currency fluctuations that could affect its profitability.

Additionally, some individuals consider forex trading as an investment strategy, holding onto currencies to benefit from interest rate differentials or appreciate in value over time.

The Risks and Rewards of Forex Trading

Forex trading is marked by its potential for both high risks and rewards. The volatile nature of currency markets means prices can shift rapidly, presenting the risk of significant losses as well as opportunities for substantial gains.

Leverage is a double-edged sword in forex trading. It allows traders to control large positions with a relatively small capital investment. While this can amplify profits, it can also magnify losses, making it crucial for traders to manage their leverage and risk exposure carefully.

Despite these risks, the forex market’s vast size and liquidity mean that even minor price movements can result in significant profits. However, traders must remember that profits are never guaranteed, and losses are a part of the trading experience.

Conclusion

Forex trading revolves around the global buying and selling of currencies, serving various purposes from speculation and hedging to investment. While it offers the potential for substantial profits, the inherent risks cannot be overlooked. Success in forex trading requires a thorough understanding of the market, a well-thought-out strategy, and disciplined risk management. By adhering to these principles, traders can navigate the complexities of the forex market and enhance their chances of success.

Leave a Reply