| Aspect | Day Trading Basics Key Takeaways |

|---|---|

| Market Size | Global currency exchange with a $7.5 trillion daily volume. |

| Operation | Operates 24/7, connecting major financial centers. |

| Participants | Individual traders, banks, institutions. |

| Focus | Currency pairs (Major, Minor, Exotic). |

| Key Concepts | Pips, leverage, spread. |

| Trading Tools | Use of charts for trading decisions. |

| Requirements | Requires broker, strategy, and risk management. |

| Risks | Market volatility, potential for significant losses. |

| Success Factors | Success needs discipline and continuous learning. |

| Advice for Beginners | Start with demo accounts and reputable brokers. |

Brief Overview of Forex Trading

Did you know that Forex stands for Foreign Exchange? People have been buying and selling foreign currencies for thousands of years. But day trading in Forex, as we know it today, started in the 1970s.

Traders make money in Forex by trading one currency for another and making money off the fluctuations in the different prices which go up and down during the day. They all do this in a very short period of time, typically within a day.

What is Forex Trading?

Forex trading involves buying and selling different countries’ currencies. The Forex market is vast, impacting the entire world with billions of dollars worth of currencies traded every day. It attracts both individuals and large corporations aiming to make profits or needing to exchange their money for foreign currency for international purchases.

Key Points:

- Accessibility: You can trade anytime, 24 hours a day.

- Participants: Includes regular people, businesses, and countries.

- Purpose: Not just for profit but also for international trade and transactions.

Understanding the Forex Market

The Forex market operates 24/7, connecting major financial cities like Tokyo, London, and New York. Trading is continuous, as when one market closes, another opens. Currency pairs form the basis of trade, with the goal to buy low and sell high. Predicting currency strength is crucial for successful trading.

How it Works:

- Global Operation: Runs 24 hours a day, 5 days a week.

- Currency Pairs: Trade one currency for another (e.g., USD/EUR).

- Trading Strategy: Buy low, sell high based on currency value predictions.

Major Players in the Forex Market

In the Forex market, there are all kind of participants, like

- Central Banks and Governments: Manage currency and economic stability.

- Big Banks and Financial Companies: Facilitate trades for clients and manage risks.

- Retail Traders: Engage in trading for personal gain or hedging.

- Forex Brokers: Offer platforms for individuals to access Forex markets.

Types of Currency Pairs

Currency pairs categorize as Major, Minor, or Exotic, based on their trading volume and market liquidity. Understanding the dynamics of these pairs is essential for effective trading.

- Major Pairs: Highly traded, including EUR/USD, USD/JPY.

- Minor Pairs: Involve major currencies but are less traded, like EUR/GBP.

- Exotic Pairs: Pair a major currency with one from an emerging economy.

Prices move based on things like economic data, politics, interest rates, and speculation in each country. Knowing what impacts currency values is key for Forex traders.

Key Forex Trading Terms

Pips, lots, and leverage are important Forex trading terms. Pips measure how much a currency pair moves up or down in price. Lots are how much currency you want to buy or sell. Leverage lets you borrow money from your broker to trade more than you have.

Other key terms are spread, margin, and equity. The spread is the difference between the buy and sell price. Margin is the money needed in your account to open a trade. Equity is the total value of your trading account.

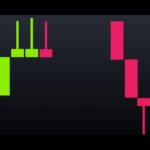

You can take long positions by buying a currency pair, or short positions by selling a pair.

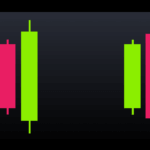

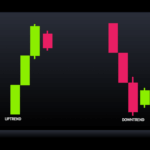

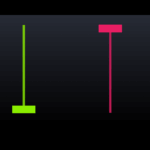

How to Read Forex Charts

There are line charts, bar charts, and candlestick charts in Forex trading. Line charts simply show the currency price movements over time. Bar charts have bars indicating the high, low, open and close prices.

Time frames let you look at data per second, minute, hour, day, week and more.

Charts are important because traders use these to see when to buy or sell currencies.

Click for more information on Candlesticks.

The Basics of Making a Forex Trade

First, of all you need to understand everything about Daytrading. You need a trading platform and broker and of course money. You need a trading plan – an Advantage over the rest and your rules for when to buy and sell.

To make a trade, you open a position by buying or selling a currency pair through your broker. Later, you close that position to take your profit or loss.

Use stop-loss orders to automatically exit if the trade goes against you too much. Take-profit orders automatically close a winning trade at your target price.

Forex Trading Risks and Challenges

Forex can be risky because currencies can swing up and down a lot really fast. Leverage lets you trade big, but also risks bigger losses.

Trading puts your mind and emotions to the test. Staying calm and following your plan is important.

Even pros keep learning about Forex every day. You have to study the markets and practice being disciplined to get better over time.

Remember, 95% of day traders are not profitable in the long run.

You need to take trading really seriously. It’s easy to get in and start to trade, but earning consistently per month is really difficult. It’s you against the rest of the trading world. Your competitors are banks, countries, professional traders who have the most advanced computers. Their systems cost millions, if not more, so be aware of the risks.

Getting Started with Forex Trading

To begin Forex trading, you need to pick a good broker. Don’t just choose any broker – do your research! Pick brokers that are trusted, don’t cost too much, have good trading tools, and have been around for a long time.

Next, most brokers let you open a free demo account to practice trading before risking real money. This is an amazing way for total beginners to learn risk-free!

Forget risking real money! This is how beginners can learn forex risk-free with a demo account.

Last but not least, keep on learning every day. You can start with free resources like YouTube videos or explore paid courses and coaches. Always do your background research and check reviews on Google or read the comments of Youtube videos before committing to any paid service. Beware of scammers!

Conclusion

Learning the Forex fundamentals is so important for brand new traders. Don’t rush into live trading until you really understand how the markets work!

Be cautious and make informed, careful decisions as you take your first steps in Forex. It’s an exciting opportunity, but the risks are very real.